We had the pleasure of speaking with Ben Kuncaitis from K Group Companies, a second-generation family business that has been in the technology space for over 40 years. Ben shared his insider insights on how the industry has evolved, their company’s history, artificial intelligence, and how businesses can prepare for the constantly changing industry.

We had the pleasure of speaking with Ben Kuncaitis from K Group Companies, a second-generation family business that has been in the technology space for over 40 years. Ben shared his insider insights on how the industry has evolved, their company’s history, artificial intelligence, and how businesses can prepare for the constantly changing industry.

About K Group Companies

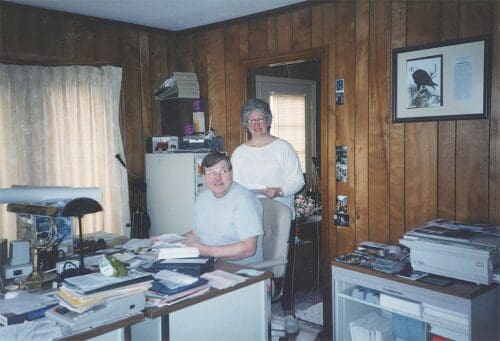

Founders Mike Sr. and Elouise Kuncaitis in the early days of K Group Companies

K Group Companies has a rich family history, dating back to 1979 when Ben’s father, Mike Kuncaitis Sr., founded the first of the K Group Companies. Mike Sr. had already been serving in the tech industry and saw a path forward to launching his own firm.

At the time, the main business consisted of supporting large mainframe computers, programming, and maintenance. They were “machines the size of a room,” explained Ben. “We had a division of our business that even fixed typewriters at one point.” Evidently, the industry has evolved significantly since their founding days.

When asked why his parents chose to work in the tech industry, Ben responded, “I think they saw it as the future. I think he was wise enough to know that.”

Ben, alongside two of his brothers – Chris and Mike, Jr.- have since taken ownership and operation of the companies. As Ben recalls, he and his siblings were integrated into the business early on. “I would say it’s in us. Tech brings a lot of challenges, and you have to like change. If you don’t like change, you’re in the wrong industry. He’s always taught us to run at challenges, not run from them.”

According to Ben, his father “had a high business acumen.” As Mike Sr. continued to build the company’s foundation, he prided himself on creating a true partner relationship with his clients by being their trusted tech advisor and consultant. To this day, this valuable legacy rings true with K Group Companies and how business is done. “We’re able to meet a client at their level and scale with them as they grow, by leveraging technology,” explained Ben.

The second generation leaders. Pictured from left to right Mike Jr., Ben, and Chris Kuncaitis

Industry Insights

In their more than forty years in business, a lot has changed in the industry. “As far as going from where the supercomputer was the size of a room, to where it can basically fit in the palm of your hand. That’s quite a swing.” Naturally, the landscape shifted alongside the structures themselves.

One industry shift is the focus on and importance of cybersecurity. This is an ever-changing topic and is one of the fastest moving areas of technology. “It’s not a matter of “if”, but “when”, there will be a breach,” said Ben. “A breach is going to happen, so it’s important to put yourself in a position of strength, in the healthiest way possible.”

K Group’s Evolution

The K Group team at a team outing

To support this, the company recently rebranded as K Group Companies, effectively combining their four primary divisions under one umbrella.

These divisions include Standard Computer Systems Inc., Riverview Service, K Data Systems, and Data Consultants. This approach allows them to provide clients with finely tuned solutions, provided by their team of highly skilled, experienced, and specialized professionals.

The unification of their brands brings better alignment to their new divisions in the previous individual companies, as well as making their services more accessible to customers that traditionally work with one or more of the teams.

Through internal growth with new ventures and acquisitions over the years, K Group Companies can provide services for about anything pertaining to technology. Much like technology itself, the family business K-Group Companies has consistently expanded and evolved along with the industry.

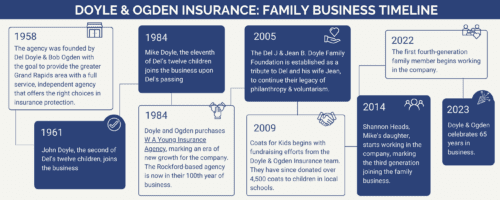

All photos are courtesy Doyle & Ogden. The interview has been edited for length and clarity.

Family Business Alliance strives to help family businesses with the tools, resources, and connections to help businesses succeed. Learn more about our resources including

All photos are courtesy Doyle & Ogden. The interview has been edited for length and clarity.

Family Business Alliance strives to help family businesses with the tools, resources, and connections to help businesses succeed. Learn more about our resources including

Business Group. Maintaining the same name, values, and customer service, WM Uniform is carrying the family’s legacy and team forward through the partnership.

Business Group. Maintaining the same name, values, and customer service, WM Uniform is carrying the family’s legacy and team forward through the partnership.

Family Business Alliance strives to help family businesses with the tools, resources, and connections to help businesses succeed. Learn more about our resources including

Family Business Alliance strives to help family businesses with the tools, resources, and connections to help businesses succeed. Learn more about our resources including

family business’s most important contribution?

family business’s most important contribution? Over the last year, SecurAlarm has embarked on a business model shift, which we are still in the midst of. We are shifting our focus from products to services because we believe security is so much more than technology and transactional relationships.

We want to align technology, procedure, and training unlike any other security integrator out there. We want to deliver personalized, comprehensive, and strategic plans and solutions to our clients, who we think of as partners. So much change is required, and it will be a long journey, but we know it will allow us to better serve our team and clients for another 100 years. Why the shift? It goes back to our Why, of course! We Care, So We Protect.

All photos are courtesy SecurAlarm.

Over the last year, SecurAlarm has embarked on a business model shift, which we are still in the midst of. We are shifting our focus from products to services because we believe security is so much more than technology and transactional relationships.

We want to align technology, procedure, and training unlike any other security integrator out there. We want to deliver personalized, comprehensive, and strategic plans and solutions to our clients, who we think of as partners. So much change is required, and it will be a long journey, but we know it will allow us to better serve our team and clients for another 100 years. Why the shift? It goes back to our Why, of course! We Care, So We Protect.

All photos are courtesy SecurAlarm.

This feature is part of our Member Anniversary Program. For more information or if you are interested in exploring opportunities to be featured, please email aislinn@fbagr.org.

Family Business Alliance strives to help family businesses with the tools, resources, and connections to help businesses succeed. Learn more about our resources including

This feature is part of our Member Anniversary Program. For more information or if you are interested in exploring opportunities to be featured, please email aislinn@fbagr.org.

Family Business Alliance strives to help family businesses with the tools, resources, and connections to help businesses succeed. Learn more about our resources including

in the last 10-20 years.” When Allison was a teenager, they began offering wedding services again and Ludema’s continues to expand and connect within the West Michigan Community.

in the last 10-20 years.” When Allison was a teenager, they began offering wedding services again and Ludema’s continues to expand and connect within the West Michigan Community.

1. What are our core family values and how do they impact our success?

1. What are our core family values and how do they impact our success?

Scott Hill

Scott Hill